Butyl Acetate Weekly Report 19 Aug 2017

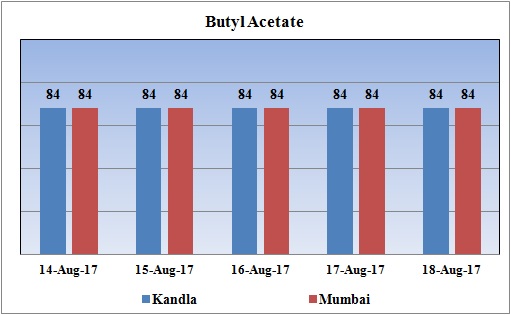

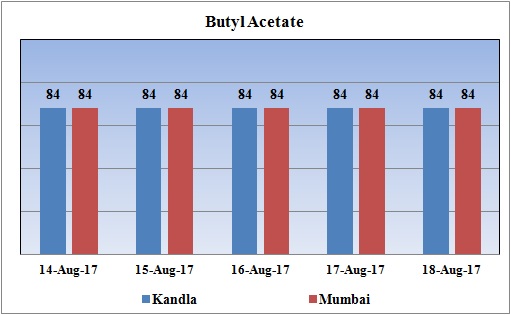

Weekly Price Trend: 14-08-2017 to 18-08-2017

- The above graph focuses on the weekly price trend of Butyl Acetate for the current week.

- Compares to previous week Butyl Acetate prices decreased slightly for this week.

- Butyl Acetate prices were assessed at the level of Rs.84/Kg for Kandla and for Mumbai ports of India.

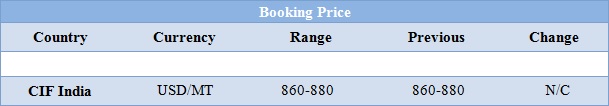

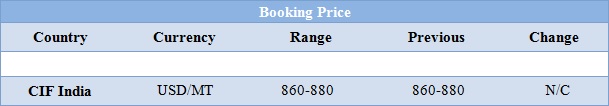

Booking Scenario

The above chart shows the international prices of Butyl Acetate and its comparison from the previous prices. These booking prices for CIF India are for 0% duty.

INDIA & INTERNATIONAL

- Butyl Acetate prices reduced slightly for this week. With monsoon season across the country, demand has slightly reduced in domestic markets. Prices were assessed at the level of Rs. 84/Kg for Kandla and Mumbai port of India.

- CIF India prices were assessed in the range of USD 860-880/MT, remained unchanged in compare to last week’s closing values.

- Due to ongoing monsoon season demand for BA also reduced in domestic consumption. Now with starting of festive season across the nation requirement for paints and coatings will increase will in turn boost up the demand for this chemical.

- There has been continuous oscillation in crude prices for this week. On Thursday oil prices rose as renewed attention was put on U.S. oil stockpile declines at Cushing, the delivery hub for U.S. crude futures.

- On Thursday, closing crude values have increased.WTI on NYME closed at $47.09/bbl, prices have increased by $0.31/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.76/bbl in compared to last trading and was assessed around $51.03/bbl.

- Market players further anticipate that crude oil prices are likely to trade sideways on the back of short covering after drop in prices. As per market predictors, the oil market has experienced a high level of disruptions to crude supply in recent years. Prices could spike above $70 a barrel if recently restored production in Nigeria and Libya falls again. But it could also sink below $40 if disruptions elsewhere in the world get resolved, putting more crude oil into the market.

- Moreover, OPEC reported its production continued to rise despite its supply quota deal with Russia. Analysts remain unconvinced that OPEC can re-balance the global oil markets without full participation from all cartel members.

$1 = Rs. 64.14

Import Custom Ex. Rate USD/ INR: 65.15

Export Custom Ex. Rate USD/ INR: 63.45