ACN Weekly Report 30 Sep 2017

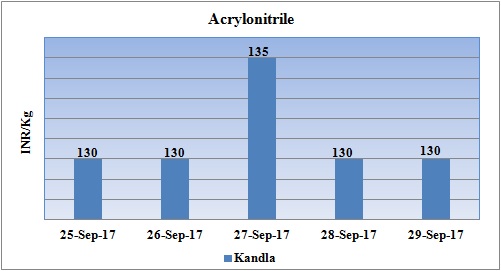

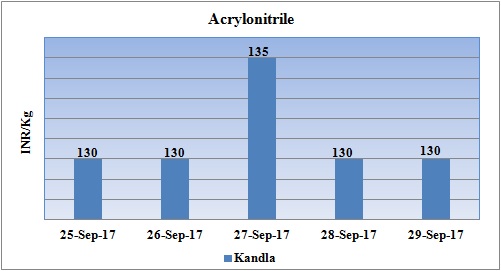

Weekly Price Trend: 25-09-2017 to 29-09-2017

- The above given graph focuses on the ACN price trend from25th September to 29th September 2017. In compare to last week’s closing values there has been significant hike in domestic prices in mid of the week.

- Domestic prices were assessed at the level of Rs.130/Kg, with an hike of Rs. 1/Kg in compare to last week’s closing values.

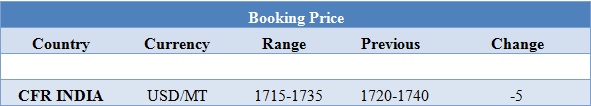

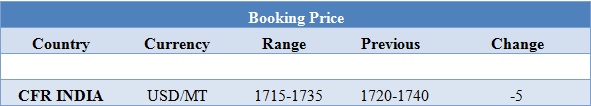

Booking Scenario

The above chart shows the international prices of ACN. CFR India prices of ACN were assessed in the range of USD 1715-1735/MT.

INDIA& INTERNATIONAL

- Domestic prices of ACN remained stable to firm for this week. Prices were assessed at the level of Rs.130/Kg for bulk quantity.

- CFR India prices of Acrylonitrile were assessed in the range of USD 1715-1735/MT, reduced by USD 5/MTS in compare to last week’s closing values.

- Feedstock value has also now settled in the international market. CFR China prices for Propylene were assessed around USD 995/mt. FOB Korea values for Propylene were assessed around USD 950/MT, while CFR SEA prices were assessed around USD 875/MT.

- This week oil prices have followed mixed trend. Investors have really gained confidence in oil, after the OPEC cuts that were originally discussed earlier in the year are starting to take shape here, and oil production is being curbed.

- On Thursday, closing crude values have plunged.WTI on NYME closed at $51.56/bbl, prices have decreased by $0.58/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.49/bbl in compared to last trading and was assessed around $57.41/bbl. Due to the combination of production cuts and growing demand, oil could head up to its 2017 high, just above $55, or even $60 per barrel by year-end. A global supply glut has plagued the market for several years, and OPEC member countries and non-member producers have vowed to implement cuts to curb such oversupply.

$1 = Rs. 65.28

Import Custom Ex. Rate USD/ INR: 65.40

Export Custom Ex. Rate USD/ INR: 63.70