ACN Weekly Report 18 June 2018

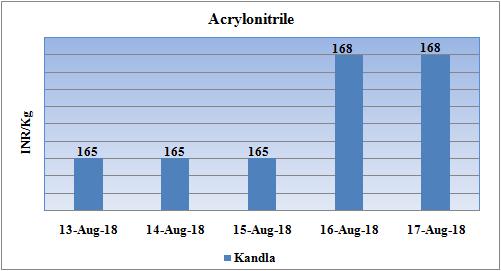

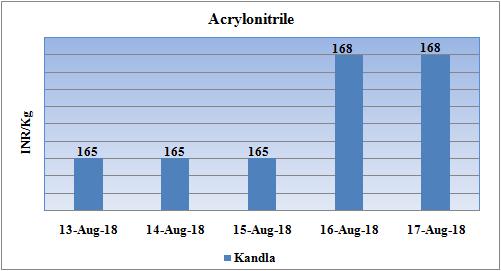

Weekly Price Trend: 13-08-2018 to 17-08-2018

- The above given graph focuses on the ACN price trend from 6th August to 10th August 2018.

- Domestic prices increased heavily for this week. Prices were assessed around Rs.168/Kg for bulk quantity by end of the week for Kandla port. There has been consistent rise in domestic prices for ACN.

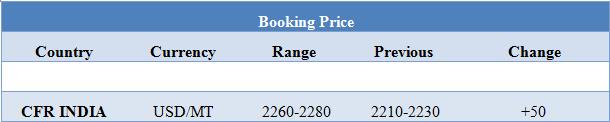

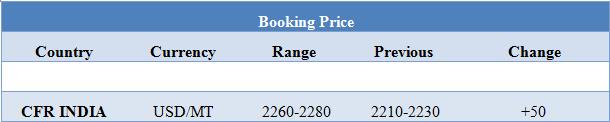

Booking Scenario

The above chart shows the international prices of ACN. CFR India prices of ACN were assessed in the range of USD 2260-2280/MT.

INDIA& INTERNATIONAL

- Prices of ACN were assessed around Rs.168/kg, heavily increased by Rs.3/Kg for this week.

- CFR India prices of Acrylonitrile were assessed in the range of USD 2260-2280/MT, increased by USD 50/MTS for this week.

- At present the prices for ACN are at its peak in last more than five years. The sole reason for this hike has been the limited supply of the chemical across the globe.

- The other major reason for increase in international as well as domestic market is that there has been significant decline in Indian currency on Monday. The rupee crossed the mark of Rs.70 against US currency. The ongoing low in global currencies following fears that Turkish economic crisis could engulf world economy. Experts believe that rupee was mainly impacted by a fall in Turkish Lira. Further the RBI intervention helped to recover from heavy losses and pushed the rupee to close at all time low level of 69.91. All the payments in petrochemical industry are done in dollar so this will have an adverse impact on prices of petrochemical products.

- Similar scenario is witnessed by Lira of Turkey and Rupees of India. Plunging of Yuan has compelled the importers to look for domestic market to cover up their requirements. A weak currency makes US dollar-denominated imports more expensive. As China is a major importer of petrochemical products in Asia, its absence translates to some downward pressure on regional markets. But firming Chinese domestic markets due to a sudden increase in demand as imports dwindle, also buoy up regional prices of some petrochemical products.

- This week crude oil prices have followed volatile trend. On Friday Crude prices edged higher, but were heading for yet another weekly decline on worries that oversupply would weigh on the U.S. market and that trade disputes and slowing global economic growth would slow demand for oil.

- On Friday, closing crude values have increased. WTI on NYME closed at $65.91/bbl. Prices have increased by $0.45/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.40/bbl in compare to last closing price and was assessed around $71.43/bbl.

- As per analysts, despite the bearish factors, prices were prevented from falling further because of U.S. sanctions against Iran, which target the financial sector from August and will include petroleum exports from November.

$1 = Rs. 70.15

Import Custom Ex. Rate USD/ INR: 61.10

Export Custom Ex. Rate USD/ INR: 69.40