ACN Weekly Report 10 Feb 2018

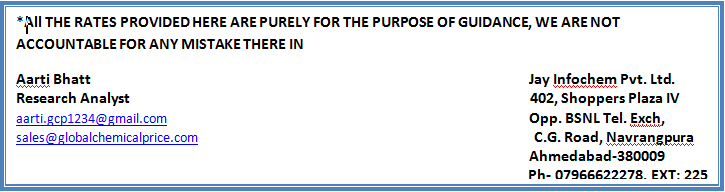

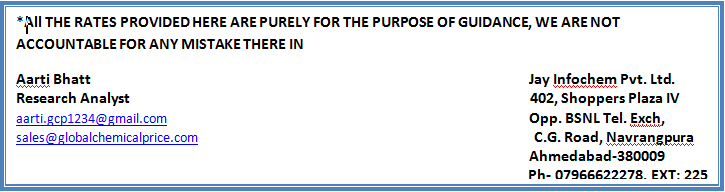

Weekly Price Trend: 05-02-2018 to 09-02-2018

- The above given graph focuses on the ACN price trend from 5th Feb to 9th Feb 2018. In compare to last week’s closing values there has been bulk hike in domestic values. Prices increased by Rs.50/Kg in domestic market.

- Domestic prices increased heavily due to limited supply of chemical in the domestic and international market.

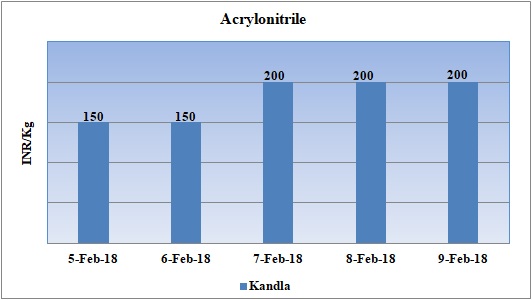

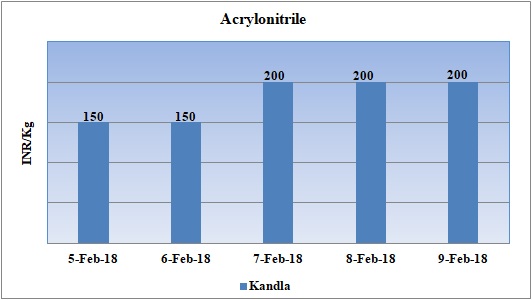

Total imports of ACN in the year 2017

The above graph depicts the total imports of ACN on monthly basis in the ear 2017. On an average 9000-10000 MT has been the imports every month in the country.

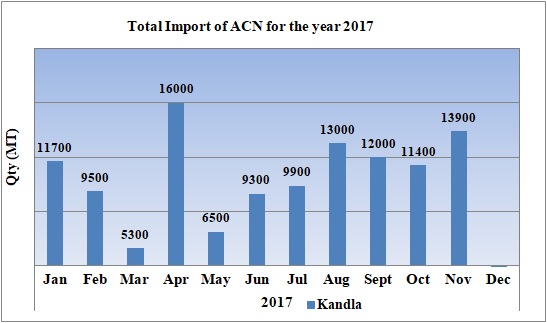

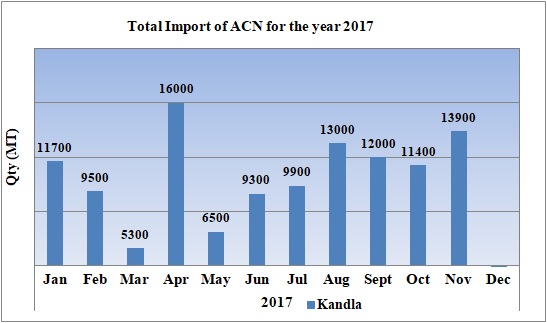

Booking Scenario

The above chart shows the international prices of ACN. CFR India prices of ACN were assessed in the range of USD 2040-2060/MT.

INDIA& INTERNATIONAL

- After an unprecedented hike in values in last few months the domestic values has been increased further this week. Prices of ACN were assessed around Rs.200/Kg, increased by Rs.50/Kg for bulk quantity in span of one week.

- CFR India prices of Acrylonitrile were assessed in the range of USD 2040-2060/MT, increased by USD 200/MTS in compare to last week’s closing values.

- There has been override in ACN prices in Asian markets since last few weeks. The tightening in the supply has been the sole reason for this gain. The Indian traders are at the worst end as prices are increasing significantly since last few weeks. Further many manufacturers are storing the material for future use as well as many ACN manufacturing units is likely to undergo maintenance schedule in the month of April and May.

- The majority of ACN imported is used by AF sector in India. The AF manufacturers are facing troublesome time as their margins are reduced to significant level and they cannot afford this hike in ACN values.

- In China, users are piling up the stock as in next few most of the market will remain closed due to Lunar vacation. Discussions remained firm in Indian markets. CFR India prices were heard in the range of USD 1900/MT. Traders are facing hard to absorb this rate in India as majority of ACN is used in AF sector. In current position AF prices are finding it hard to keep up the pace with ACN prices.

- South Korea based Taekwang Industrial has shut down its ACN unit for maintenance turnaround. The unit has been shut down for maintenance schedule.

- Unit is based at Uslan in South Korea and has the production capacity of 2,90,000 mt/year.

- There has been increase in domestic values along with hike in international prices. But this hike was subdued as week progressed. In the latter half of the week there has been heavy decline in crude values which in turn led to slight weakening of other petrochemical products.

- This week crude oil prices have followed weak trend. Oil prices fell sharply after the U.S. government reported crude stockpiles rose by 1.9 million barrels. The increasing U.S. oil production and crude stockpiles, and stock market sell-off, piled pressure on oil prices this week. A stronger dollar has also been a prevailing factor the decline. But the supply dynamics are working against a sustained price rally.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $61.15/bbl; prices have decreased by $0.64/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.70/bbl in compared to last trading and was assessed around $64.81/bbl.

- As per market analyst oil market moves could be exaggerated because the number of bets that crude prices will keep climbing has risen sharply, while wagers that prices will fall have plunged. That extreme market positioning can encourage bouts of profit-taking.

$1 = Rs. 64.40

Import Custom Ex. Rate USD/ INR: 64.40

Export Custom Ex. Rate USD/ INR: 62.85