ACN Weekly Report 07 Oct 2017

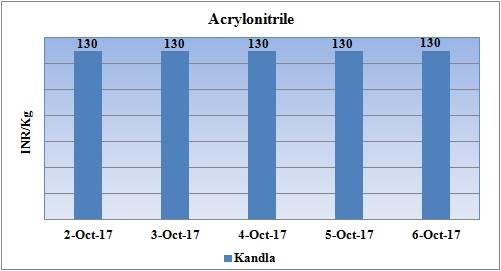

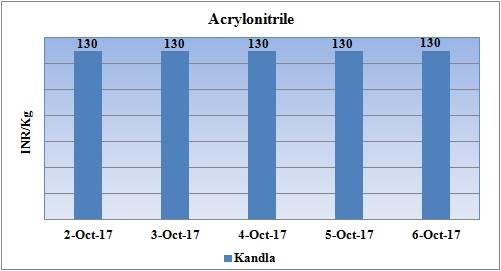

Weekly Price Trend: 02-10-2017 to 06-10-2017

- The above given graph focuses on the ACN price trend from 2nd Oct to 6th Oct 2017. In compare to last week’s closing values remained stable for this week.

- Domestic prices were assessed at the level of Rs.130/Kg, with no change in compare to last week’s closing values.

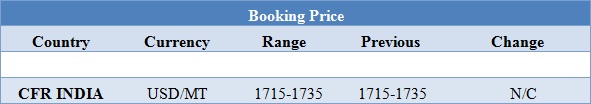

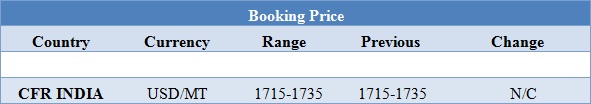

Booking Scenario

The above chart shows the international prices of ACN. CFR India prices of ACN were assessed in the range of USD 1715-1735/MT.

INDIA& INTERNATIONAL

- Domestic prices of ACN remained stable to firm for this week. Prices were assessed at the level of Rs.130/Kg for bulk quantity.

- CFR India prices of Acrylonitrile were assessed in the range of USD 1715-1735/MT, with no change in compare to last week’s closing values.

- Feedstock value has also now settled in the international market. CFR China prices for Propylene were assessed around USD 995/mt. FOB Korea values for Propylene were assessed around USD 950/MT, while CFR SEA prices were assessed around USD 875/MT.

- There has been continuous surge in ACN prices in Asian markets. The surge has been more than 30% in last two months. With golden week holidays in China market the hike is likely to settle down in Asian markets. Majority of the buyers tend to stay away in China during these holidays. Thi sin turn has led to slowdown in ACN and other feedstock values.

- This unexpected rise has been particularly due to shut down of many ACN China based units and shut down of ACN units in US due to Harvey.

- Qilu Petrochemical unit based in China has not been restarted yet having the production capacity of 80,000 mt/year. Jilin Petrochemical’s having capacity of 106,000 tonne/year No 1 ACN unit in northeastern China was taken off line on 12 June for the same reason and is expected to be restarted this month. Its othe unit having the production capacity of 120,000 tonne/year capacity was also shut on 9 August and resumed production in late September.

- Most market participants attributed the sharp price rise to reduced supply in Asia caused by unexpected shutdowns of some Chinese plants and following a production disruption at a major facility in the US.

- Crude price remained volatile throughout this week. On Wednesday after slipping a bit oil prices rose again on Thursday based on expectations that Saudi Arabia and Russia would extend production cuts, although record U.S. exports and the return of supply from a Libyan oilfield dragged on the market.

- On Thursday, crude values closed on higher note. WTI on NYME closed at $50.79/bbl, prices have increased by $0.81/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $1.20/bbl in compared to last trading and was assessed around $57.00/bbl.

- As per market players, OPEC and other producers, including Russia, to cut oil output to boost prices could be extended to the end of 2018, instead of expiring in March 2018.

$1 = Rs. 65.38

Import Custom Ex. Rate USD/ INR: 65.95

Export Custom Ex. Rate USD/ INR: 64.30