Acetic Acid Weekly Report 8 Feb 2019

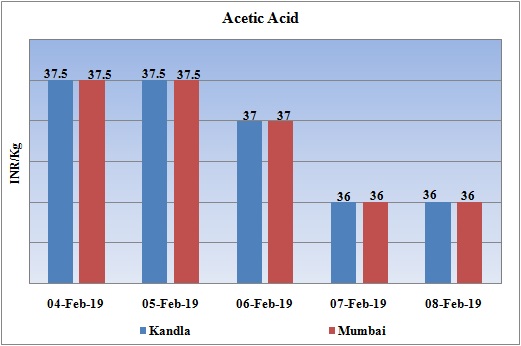

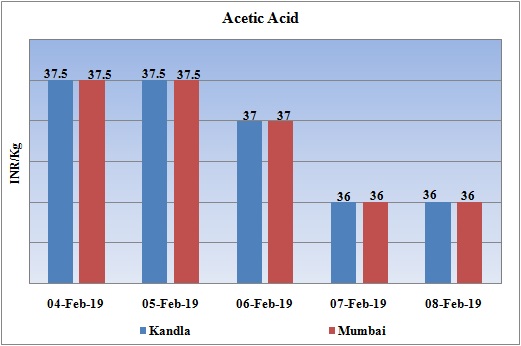

Weekly Price Trend: 04-02-2019 to 08-02-2019

- The above given graph focuses on the Acetic Acid price trend from 4th February to 8th February 2019. If we take a quick look at the above given weekly prices, it can be observed that prices remained highly vulnerable declined in domestic market.

- With continuous fluctuation in crude values prices there has been throughout rise in domestic values for this week.

- By end of this week, prices were assessed at the level of Rs.36/Kg for Kandla and for Mumbai port for bulk quantity.

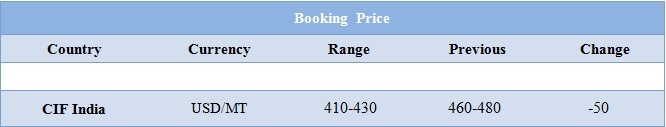

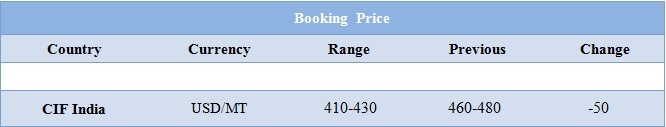

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid assessed around Rs.36/Kg for Kandla and for Mumbai port of India. This week domestic prices has reduced and subtle around the week.

- CIF India prices for Acetic Acid were assessed around USD 410-430/MT reduced by USD 50/MT in compare to last week’s closing values.

- Major producer Celanese on 1 February announced a $90/tonne hike on acetic acid in Asia outside China.

- Demand is likely to improve only after Luna holidays in China as many plants are likely t go off-stream for maintenance.

- The lack of strong demand in the broader Asian market also led suppliers to remain more conscious and alert.

- Prices for Methanol have remained stable since last few weeks has also affected the Acetic Acid values in domestic as well as international market.

- International prices for Methanol for this week were assessed around USD 305/MT increased by USD 15/MT for this week. Methanol values remained flat in China market.

- Benchmark Brent oil inched up on Friday but was heading for a weekly loss, pulled down by worries about a global economic slowdown, although OPEC-led supply cuts and U.S. sanctions against Venezuela provided crude with some support.

- U.S. President Donald Trump said on Thursday that he did not plan to meet Chinese President Xi Jinping before a March 1 deadline set by the two countries to strike a trade deal.

- Adding to demand concerns, the European Commission sharply cut its forecasts for euro zone economic growth due to global trade tensions and an array of domestic challenges.

- Supply cuts led by the Organization of the Petroleum Exporting Countries lent support. OPEC kingpin Saudi Arabia reduced its output in January by about 400,000 barrels per day (bpd) to 10.24 million bpd, OPEC sources said.

- Another risk to supply comes from Venezuela after the implementation of U.S. sanctions against the OPEC member's petroleum industry in late January. Analysts expect this move to knock out 300,000-500,000 bpd of exports.

PLANT NEWS

Acetic Acid plant to be shut down by Daicel Industries

- Japan based Daicel Industries is likely to shut down its Acetic Acid unit for maintenance turnaround. The unit is likely to go off-stream for around one month.

- Unit is based at Himeiji in Hyogo province of Japan and has the production capacity of 4,20,000 tonnes/year.

- Major acetic acid producers in Asia include BP, Celanese, China’s Jiangsu Sopo, Shanghai Wujing, Yankuang Cathay Coal Chemicals, Taiwan’s Chang Chun Petrochemical and Saudi Arabia’s International Acetyl Company.

1$: Rs. 71.18

Import Custom Ex. Rate USD/ INR: 72.65

Export Custom Ex. Rate USD/ INR: 70.90