Acetic Acid Weekly Report 29 November 2019

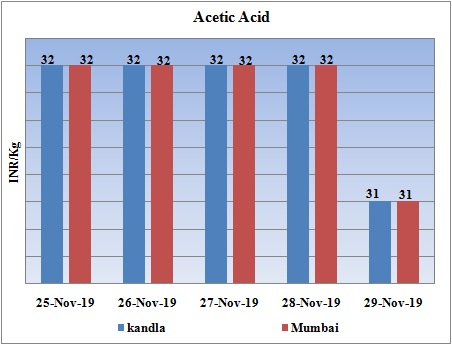

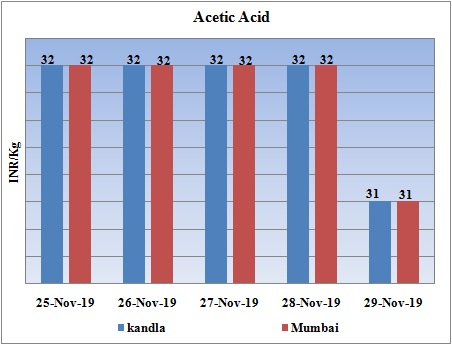

Weekly Price Trend: 25-11-2019 to 29-11-2019

- The above given graph focuses on the Acetic Acid price trend from 25th Nov to 29th Nov 2019. If we take a quick look at the above given weekly prices, it can be observed that prices has remained stable for most of the week.

- By end of the week prices were assessed at the level of Rs.31/Kg, slightly reduced in this week.

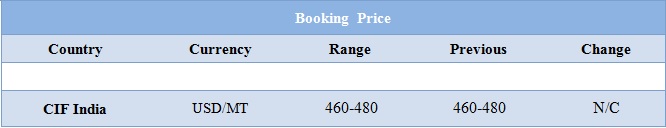

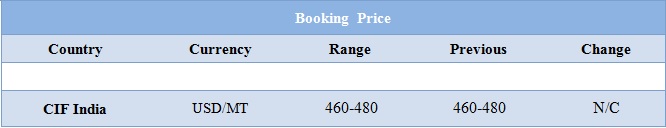

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid were assessed around Rs.31/Kg for Kandla and for Mumbai port of India.

- CIF India prices for Acetic Acid were assessed around USD 460-480/MT, with no change in values for this week.

- Prices for Methanol on other side remained stable with slight decline in values. CFR India prices were assessed at the level of USD 194/MT, reduced by USD 1/MT for this week.

- Benzene the major source for aromatic products also increased for this week. FOB Korea values for Benzene were assessed around USD 657/MT for this week, while CFR China prices were assessed at the level of USD 665/MT for this week.

- Crude oil prices on Thursday gained Rs 5 at Rs 4,132 per barrel as speculators created fresh positions amid positive trend in spot market.

- Analysts said raising of bets by participants kept crude prices higher in futures trade.

- On the Multi Commodity Exchange, crude for delivery in December traded higher by Rs 5, 0.12 per cent, to Rs 4,132 per barrel in 25,895 lots.

- Refineries across the United States have reduced their total crude oil processing so far in 2019, as demand for oil products both in America and abroad have weakened.

- There has been slowdown in demand at home and weakening demand abroad, and amid a fuel glut in Asia, refiners in the U.S. have processed lower volumes of crude oil so far this year. The cutting of rates has helped refiners avoid a fuel glut domestically, but lower processing rates have built an oversupply in crude, Kemp notes.

1$: Rs. 71.74

Import Custom Ex. Rate USD/ INR: 72.75

Export Custom Ex. Rate USD/ INR: 71.05