Acetic Acid Weekly Report 27 December 2019

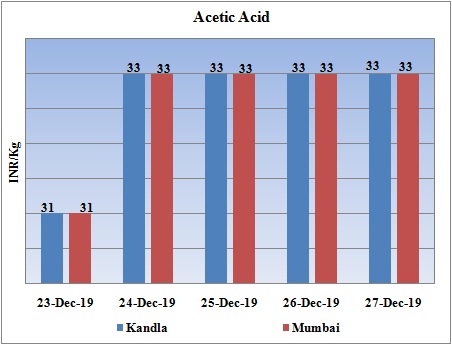

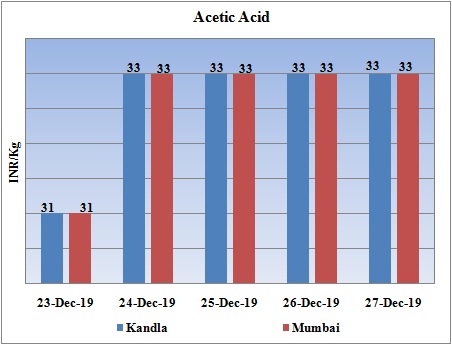

Weekly Price Trend: 23-12-2019 to 27-12-2019

- The above given graph focuses on the Acetic Acid price trend from 23rd Dec to 27th Dec 2019. If we take a quick look at the above given weekly prices, it can be observed that prices has remained stable for this week.

- By end of the week prices were assessed at the level of Rs.33/Kg, slightly increased in this week.

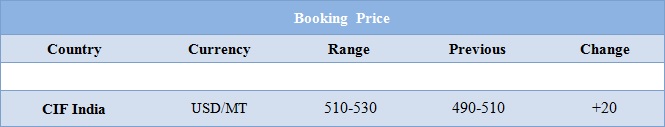

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid were assessed around Rs.33/Kg for Kandla and for Mumbai port of India.

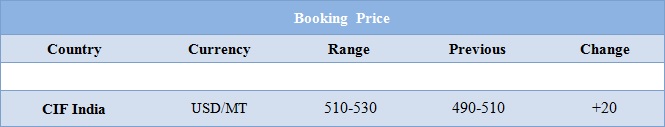

- CIF India prices for Acetic Acid were assessed around USD 510-530/MT, increased by USD 20/MTS for this week.

- Prices for Methanol on other side improved slightly for this week. CFR India prices were assessed at the level of USD 200/MT, increased by USD 4/MT for this week.

- Benzene the major source for aromatic products has increased significantly for this week. Price rise has been whooping for this week. FOB Korea values for Benzene were assessed around USD 735/MT for this week, increased by USD 60/MT for this week, while CFR China prices were assessed at the level of USD 640/MT for this week.

- On Thursday, closing crude values have increased. WTI on NYME closed at $61.68/bbl. Prices have increased by 0.57/bbl in compared to last closing prices. While Brent on Inter Continental Exchange is increased by 0.72/bbl in compare to last closing price and was assessed around $67.92/bbl.

- Persistent oversupply of crude in the global oil and gas market has created a difficult situation for smaller oil and gas companies who must find ways to compete in a debt-laden, low-priced environment against state-run oil titans like Saudi Aramco and deep-pocketed oil giants such as Exxon.

- But the small oil and gas players-those private companies that are facing an uncertain future despite sitting atop a literal wealth of oil and gas in prolific US shale plays-may have just been handed their ticket out of trouble by the largest oil importer in the world, China.

1$: Rs. 71.36

Import Custom Ex. Rate USD/ INR: 71.90

Export Custom Ex. Rate USD/ INR: 70.20