Acetic Acid Weekly Report 26 May 2018

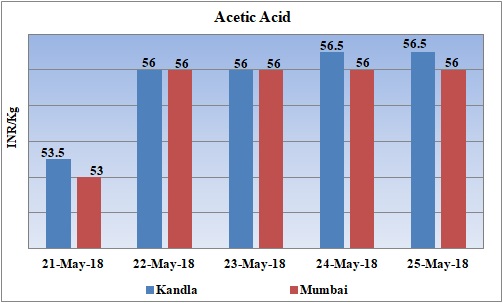

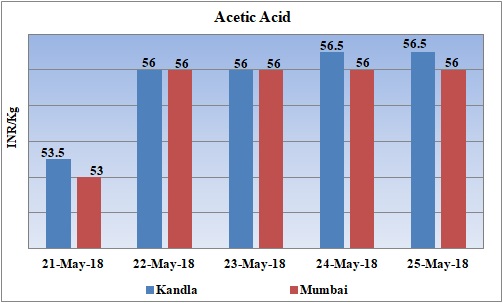

Weekly Price Trend: 21-05-2018 to 25-05-2018

- The above given graph focuses on the Acetic Acid price trend from 21st May 2018 to 25th May 2018. If we take a quick look at the above given weekly prices, it can be observed that prices has been increasing week over week.

- Domestic prices have increased to high level due to acute supply in the local market.

- By end of this week, prices were assessed at the level of Rs.56.5/Kg for Kandla and Rs.56/Kg for Mumbai port for bulk quantity.

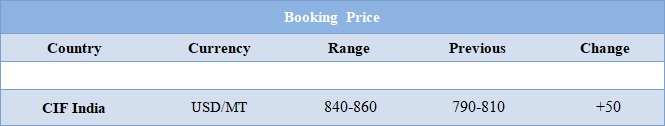

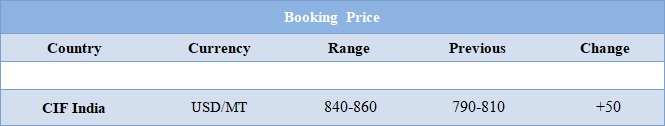

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid assessed around Rs.56.5/Kg for Kandla and Rs.56/Kg for Mumbai port of India. Prices remained vulnerable throughout this week.

- CFR India price were assessed around USD 840-860/MT with an increase of USD 50/MT hange in compare to last week’s closing values.

- There has been acute supply of chemical in the domestic market which in turn has led to significant hike in prices. The prices are expected to soar up further as there is no relief in the supply end.

- As reported earlier there has been major shut down and force majeure at Acetic Acid plant based in US in last few weeks. This has led to higher demand from US market for Acetic Acid. To mention few BP has shut down its Acetic Acid unit based in Texas.

- China is one of the prime suppliers of Acetic Acid in Asian as well as American market. Prices have increased by more than 15% in domestic market of China. The other major units in Asian are also under maintenance.

- Acetic Acid unit of Celanese based in Singapore was shut down last month and is likely to resume production in June. The other major unit Chang Chung based in Taiwan has also resume production in this month after technical fault.

- In China itself the market condition are not so good. The Acetic Acid supply is very limited as many of the major units are shut down or will undergo maintenance. To add further there has been heavy demand from PTA industry along with VAM manufacturers. Few major units are expected to start their production in the next month.

1$ : Rs. 67.75

Import Custom Ex. Rate USD/ INR: 68.65

Export Custom Ex. Rate USD/ INR: 66.95