Acetic Acid Weekly Report 23 Dec 2017

Weekly Price Trend: 18-12-2017 to 22-12-2017

- The above given graph focuses on the Acetic Acid price trend from 18th Dec 2017 to 22nd Dec 2017. If we take a quick look at the above given weekly prices, it can be observed that there has been heavy fall in domestic values.

- Last week there has been an unprecedented hike in domestic values due to limited supply of chemical in the international market. By end of this week, prices were assessed at the level of Rs.47/Kg for Kandla and for Mumbai port for bulk quantity.

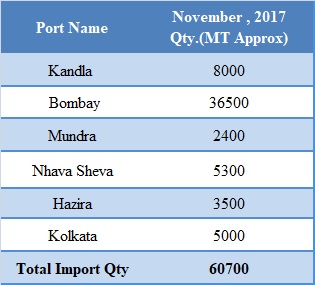

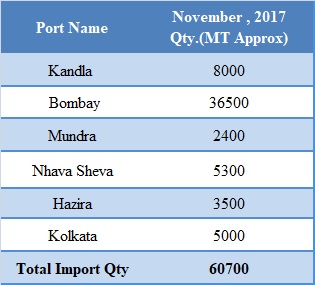

Total import at various ports in the month of November 2017

The above chart depicts the import of Acetic Acid at various ports of India in the month of November 2017.There has been slowdown in imports in the month of October 2017.

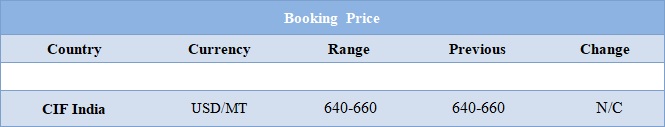

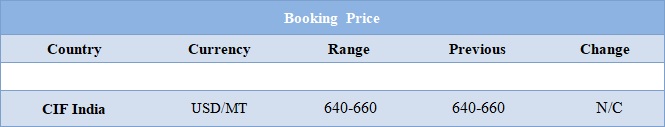

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid assessed around Rs.47/Kg for Kandla and Mumbai ports of India.

- Market has slowed down in domestic market due to supply of chemical in the market. There has been noticeable variation in domestic values.

- There has been significant slowdown in domestic values for Acetic Acid in domestic market. Since past few prices surged up due to limited supply on back of winter season issues. Now the market has suddenly changed its position. Last few weeks prices were hovering in the range of Rs.50-52/Kg for Kandla and Mumbai port.

- Yesterday prices declined to the level of Rs.47/Kg for both ports, reduced by Rs.5/Kg for bulk quantity.

- This week oil prices have followed mixed trend and closed on higher note. On Thursday, Oil prices higher, erasing earlier losses as Britain's Forties pipeline in the North Sea was expected to restart in early January after repairs over Christmas. Forties is the largest of the five North Sea crudes that underpin Brent, a benchmark for oil trading in Europe, the Middle East, Africa and Asia.

- On Thursday, closing crude values have increased. WTI on NYME closed at $58.36/bbl; prices have increased by $0.27/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.34/bbl in compared to last trading and was assessed around $64.90/bbl.

- As per market report, based on current estimates the company expects to bring the pipeline progressively back to normal rates early in the new year. Oil prices were also supported by falling crude inventories in the United States but capped by output that is fast approaching 10 million barrels per day.

- As me market predictors said that the first few months of 2018 to be either flat or a build in inventories, as it is typically the case with the seasonality in the oil market.

1$ : Rs. 64.04

Import Custom Ex. Rate USD/ INR: 64.90

Export Custom Ex. Rate USD/ INR: 63.20