Acetic Acid Weekly Report 22 November 2019

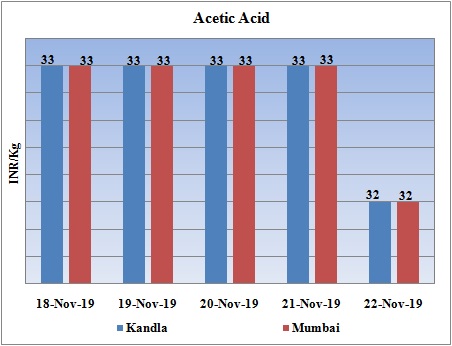

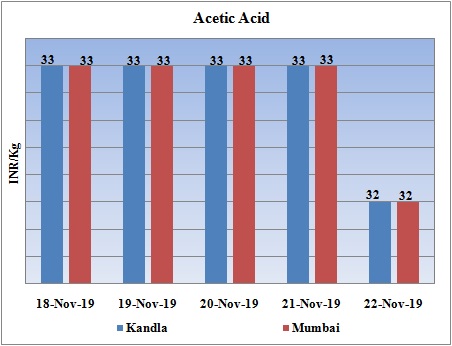

Weekly Price Trend: 18-11-2019 to 22-11-2019

- The above given graph focuses on the Acetic Acid price trend from 18th Nov to 22nd Nov 2019. If we take a quick look at the above given weekly prices, it can be observed that prices has remained stable for most of the week.

- By end of the week prices were assessed at the level of Rs.32/Kg, slightly reduced in this week.

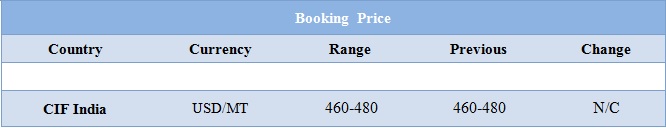

Booking Scenario

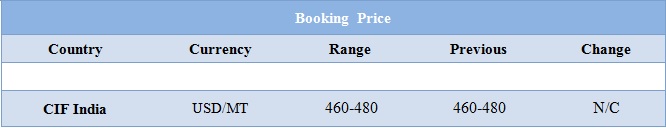

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid were assessed around Rs.32/Kg for Kandla and for Mumbai port of India.

- CIF India prices for Acetic Acid were assessed around USD 460-480/MT, with no change in values for this week.

- Prices for Methanol on other side remained unchanged for this week. CFR India prices were assessed at the level of USD 195/MT, reduced by USD 7/MT for this week.

- Benzene the major source for aromatic products also increased for this week. FOB Korea values for Benzene were assessed around USD 650/MT for this week, while CFR China prices were assessed at the level of USD 652/MT for this week.

- On Thursday, closing crude values have increased. WTI on NYME closed at $58.58/bbl. Prices have increased by 1.57/bbl in compared to last closing prices. While Brent on Inter Continental Exchange is increased by 1.57/bbl in compare to last closing price and was assessed around $63.97/bbl.

- There has been decline in oil prices as US-China trade doubts dominates in the sub continent. Oil prices have been tumbling from their highest level in last two months as uncertainty continues to cloak a potential US-China trade deal.

- The key factor for the demand outlook for oil is the (U.S.-China) trade negotiation currently going on,” said Michael McCarthy, chief market strategist at CMC Markets.

- It was also buoyed by comments from China’s commerce ministry on Thursday that it will strive to reach an initial agreement with the United States to end the pair’s long-running trade war, allaying fears that talks might be unravelling.

- News that last week saw the biggest draw down in three months for U.S. crude stock stockpiles at Cushing, Oklahoma also underpinned prices earlier this week.

1$: Rs. 71.71

Import Custom Ex. Rate USD/ INR: 72.00

Export Custom Ex. Rate USD/ INR: 70.30