Acetic Acid Weekly Report 21 Dec 2018

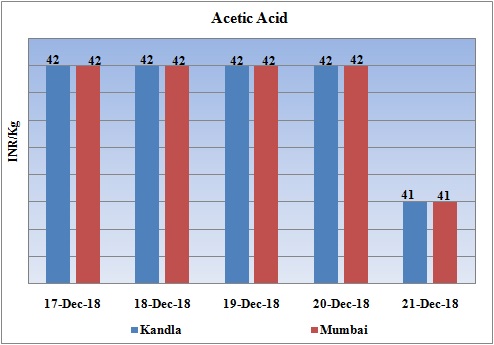

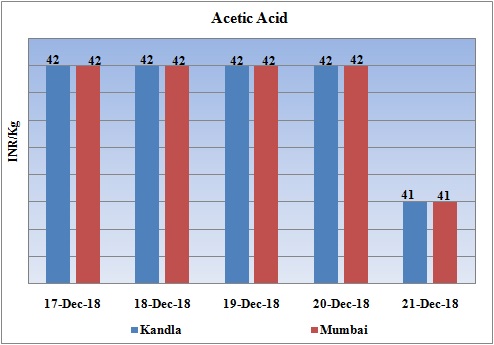

Weekly Price Trend: 17-12-2018 to 21-12-2018

- The above given graph focuses on the Acetic Acid price trend from 17thDec 2018 to 21st Dec 2018. If we take a quick look at the above given weekly prices, it can be observed that prices remained weak for this week.

- With continuous fluctuation in crude values prices and appreciation of currency against dollar has affected domestic market significantly. In compare to last week there has been decline in domestic prices.

- By end of this week, prices were assessed at the level of Rs.41/Kg for Kandla and for Mumbai port for bulk quantity.

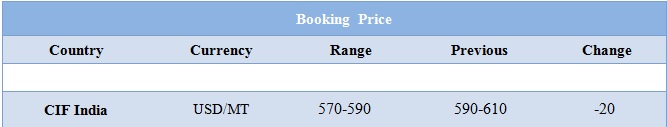

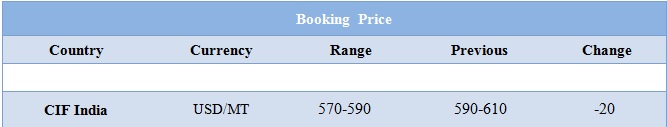

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid assessed around Rs.41/Kg for Kandla and for Mumbai port of India. There has been significant decline in the domestic values for this week.

- CIF India prices for Acetic Acid were assessed around USD 570-590/MT reduced by USD 20/MT in compare to last week’s closing values.

- Impact of decline in the Methanol values has significantly affected the Acetic Acid prices in international market. Methanol values have reduced by more than USD 8 and were assessed at the level of USD 230/MTS for this week.

- Acetic Acid prices in spot market of China remained weak and continued to slowdown due to relatively weak demand and stable supply. Earlier most of the Acetic Acid units were operated at high rates leading to high inventory levels. Experts believe that production is likely to increase in near future. With respect to demand, the downstream products are also facing weak demand and are waiting for upcoming Lunar holidays. Vinyl acetate monomer (VAM) sector, demand also remained soft as Sichuan Vinylon’s two plants with a combined 500,000 tonne/year capacity will shut for four to six weeks from end-December, while most other VAM plants in China were running at low rates. Showdown in values for Acetic Acid is also due to decline in the Methanol values in China and Asia market.

- The upcoming holiday season in China has weaken the demand further as most of the Acetate units opts for shutdown during this period.

- Crude market has been operating at lower levels since past few weeks. The prices tumbled by around 4.8% and has reduced to the levels of USD 45.88/bbl. This has reached to its lowest levels in last seventeen months. The oversupply has been the prime reason for this downfall.

- Demand for oil has reduced this year on contrary the market has been flooded with oversupply from world’s top three producers- the USA, Russia and Saudi Arabia.

- Last month earlier OPEC and other 10 producers agreed to cut down their production to remove 1.2 mln barrels per day from the market. But this step has least impact on the market. This cut down in production will last only till January 2019, further no decision has been taken yet.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $45.88/bbl. Prices have decreased by $2.29/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $2.89/bbl in compare to last closing price and was assessed around $54.35/bbl.

PLANT NEWS

- Hebei Yingdu Gasification of China has restarted its Acetic Acid unit after brief maintenance. Earlier the unit was shut down last week on immediate bases due to some technical and mechanical issue.

- The unit is based at Xingtai in Hebei province of China and has the production capacity of 5,00,000 tonnes/year.

1$: Rs. 70.14

Import Custom Ex. Rate USD/ INR: 71.75

Export Custom Ex. Rate USD/ INR: 70.05