Acetic Acid Weekly Report 16 Dec 2017

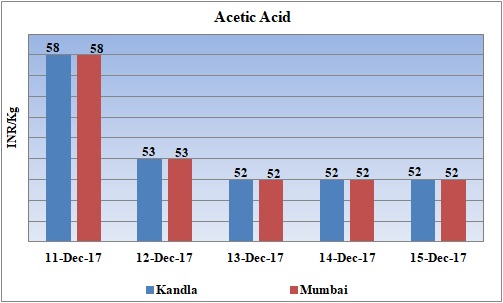

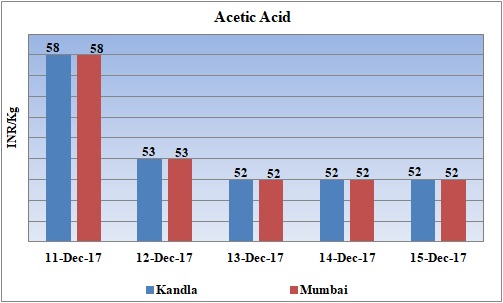

Weekly Price Trend: 11-12-2017 to 15-12-2017

- The above given graph focuses on the Acetic Acid price trend from 11th Dec 2017 to 15th Dec Nov 2017. If we take a quick look at the above given weekly prices, it can be observed that there has been heavy fall in domestic values.

- Last week there has been an unprecedented hike in domestic values due to limited supply of chemical in the international market.

- By end of this week, prices were assessed at the level of Rs.52/Kg for Kandla and for Mumbai port for bulk quantity.

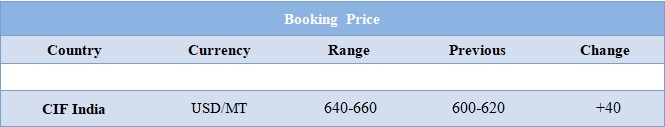

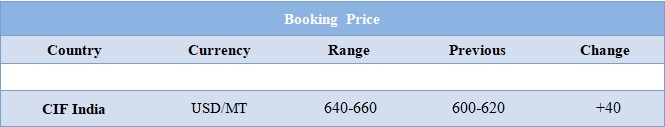

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid assessed around Rs.52/Kg for Kandla and Mumbai ports of India.

- Market has slowed down in domestic market due to supply of chemical in the market. There has been noticeable variation in domestic values.

- On contrary to domestic values there has been hike in international prices and were assessed at the level of CFR India USD 640-660/MTS, increased 40/MTS in compare to last week’s closing values.

- During this winter season most of the major producers of Iran shut their unit either for maintenance or due to shortage in the supply of natural gas.

- This week crude oil prices have followed mixed trend. On Thursday oil prices rose as a pipeline outage in Britain continued to support prices despite forecasts showing global crude surplus in the beginning of next year.

- On Thursday, closing crude values have increased. WTI on NYME closed at $57.04/bbl; prices have increased by $0.44/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.87/bbl in compared to last trading and was assessed around $63.31/bbl.

- While on Friday, Oil markets were stable as the Forties pipeline outage in the North Sea and the ongoing OPEC-led production cuts supported prices, while rising output from the United States kept crude from rising further.

- Traders said markets were overall well supported by efforts led by OPEC and Russia to withhold supply to prop up prices.

- As per market report, the oil market to have a surplus of 200,000 barrels per day in the first half of next year before reverting to a deficit of about 200,000 bpd in the second half. That means 2018 overall should show closely balanced market.

1$ : Rs. 64.04

Import Custom Ex. Rate USD/ INR: 65.40

Export Custom Ex. Rate USD/ INR: 63.70