Acetic Acid Weekly Report 14 Oct 2017

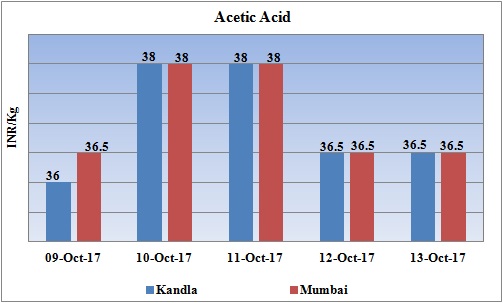

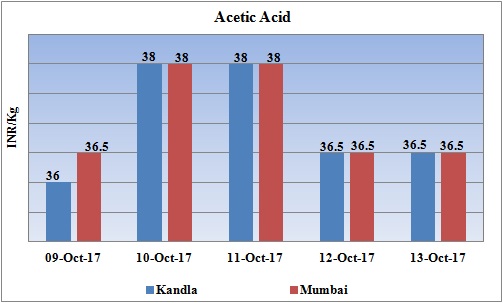

Weekly Price Trend: 09-10-2017 to 13-10-2017

- The above given graph focuses on the Acetic Acid price trend from 9th Oct 2017 to 13th Oct 2017. If we take a quick look at the above given weekly prices, it can be observed that this prices tend to remain volatile.

- By end of this week, prices were assessed at the level of Rs.36.5/Kg for Kandla and for Mumbai port for bulk quantity.

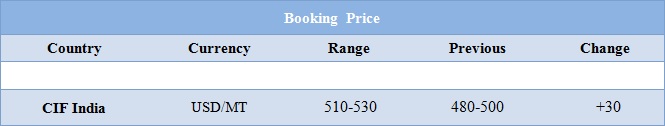

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid assessed varying mode throughout this week. There has been noticeable variation in domestic values. There has been limited supply of the chemicals in the market. Prices were assessed at the level of Rs.36.5/Kg for Kandla and for Mumbai port for bulk quantity.

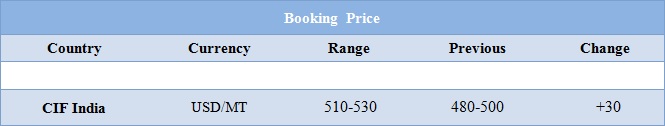

- CIF India prices of Acetic acid were assessed around USD 510-530/MTS, increased by USD 30/MTS in compare to last week’s closing values. The overall market trend remained volatile throughout this week with majority of chemicals witnessing hike in international values.

- The market is likely to remain slow due to festive across the nation. Moreover most of the markets will remain closed next week due to Diwali festival and will open only after next week.

- There has been significant hike in Acetic Acid values in China market. This upsurge took place as soon as the market reopened after golden week holidays. The local demand has been quite high while manufacturers are concentrating on their contractual customers. The demand for contractual customers has been fed first on priority basis.

- Inventories have been sinking all through this week. Producers are not operating t their full capacity.

- The domestic manufacturers are getting more demand from Europe as there has been shortfall in supply from US due to an explosion happened at acetyls producer Eastman Chemical’s complex in Kingsport, Tennessee. The complex has 255,000 tonnes/year of acetic acid capacity.

- The demand from downstream industry in domestic market has been plunging after week long holidays. To cater such demand the price the supply gets shortened and prices hike is an ultimate output.

- Tightening of pollution norms in China has been curtailing the production of the county to greater extent. Manufacturers are bound to produce the chemical in certain limit otherwise will face strict penalties by the government. Implementation of new environmental laws in China has already caused a decline in its chemicals exports and the trend is likely to accentuate in next few years. This has led to limited supply of the chemical within country and fall in exports. This upsurge has led to surging of cost of material and rise in manufacturing cost.

- There has been continuous oscillation in crude values for this week. On Thursday oil prices rebounded from earlier losses, but ended lower on the day, after the Energy Department reported a larger-than-expected decline in U.S. inventories and a falloff in weekly production.

- On Thursday, crude values closed on lower note. WTI on NYME closed at $50.60/bbl, prices have decreased by $0.70/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.69/bbl in compared to last trading and was assessed around $56.25/bbl.

- According to reports, the global outlook for oil markets in 2018 could put a dampener on hopes for higher prices. Market players said that supply growth in the final three months of the year would be supportive for oil prices in the fourth quarter. Oil prices could climb close to $60 a barrel in the "very short run."

1$ : Rs. 64.93

Import Custom Ex. Rate USD/ INR: 65.95

Export Custom Ex. Rate USD/ INR: 64.30