Acetic Acid Weekly Report 10 June 2017

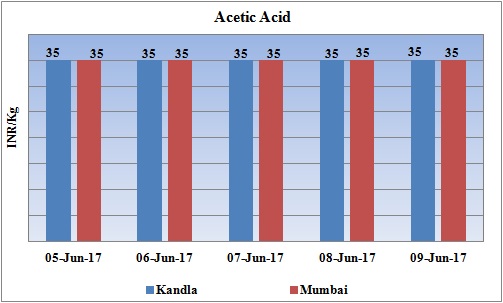

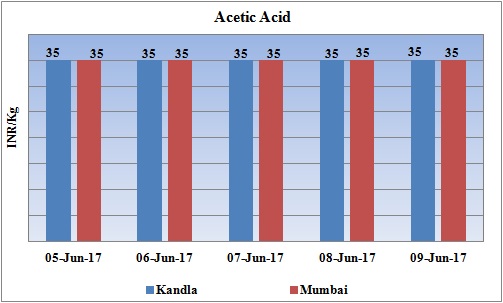

Weekly Price Trend: 05-06-2017 to 09-06-2017

- The above given graph focuses on the Acetic Acid price trend from 5th June 2017 to 9th June 2017. If we take a quick look at the above given weekly prices, it can be observed that this week there has been strengthening of domestic values in petrochemical market.

- By end of this week, prices were assessed at the level of Rs.35/Kg for Kandla and Mumbai port for bulk quantity.

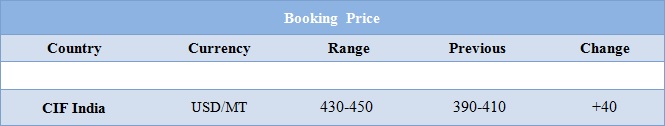

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid increased significantly for this week. With arrival of monsoon in southern part of the country many players are busy I stocking the material before it reaches the western coast of the country. Prices were assessed at the level of Rs.35/Kg for Kandla and Mumbai port for bulk quantity.

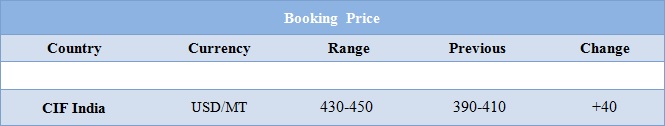

- CIF India prices of Acetic acid were assessed around USD 430-450/MTS, with an bumper increase of USD 40/MT in compare to last week’s closing values.

- The Indian market is also gearing up itself for the new tax law GST. The Indian government is in full mood to implement this GST from 1 July amid all confusion and disoriented market sentiments. Market participants are all in confused state as nothing has been clearly stated and clarified. As per last announcement by the government an 18% GST rate will apply to chemicals and polymers.

- As Indian government defines “GST is a single tax on the supply of goods and services, right from the manufacturer to the consumer… It will ensure that indirect tax rates and structures are common across the country, thereby increasing certainty and ease of doing business,”.

- Feedstock Methanol CFR India prices were assessed in the range of USD 230-240/MT.

- This week crude oil prices followed volatile trend with sluggishness trend in pricing of crude oil. On Thursday oil prices fell due to an unexpected surge in U.S. inventories from signs of rising output in Libya and Nigeria to the crude market, as two OPEC members exempt from production cuts.

- WTI on NYME closed at $45.64/bbl, prices have decreased by $0.08/bbl in compared to last closing prices.

- While Brent on Inter Continental Exchange decreased by $0.20/bbl in compared to last trading and was assessed around $47.86/bbl. On Friday oil prices stabilized due to steep falls earlier this week, but still pressured by evidence of an ongoing fuel glut despite efforts led by OPEC to tighten the market by holding back production.

- Asian markets are also oversupplied, with traders continuing to put excess crude into floating storage, a key indicator for a glut.

- Market analyst have said that oil market is anticipated to be bullish for the second half of this year, based on supply and demand balances and the rebalancing is also going to start in the second half. But if Nigerian and Libyan production is picking up well as they are now, then slowly things will be different.

1$ : Rs. 64.24

Import Custom Ex. Rate USD/ INR: 65.35

Export Custom Ex. Rate USD/ INR: 63.70