Acetic Acid Weekly Report 1 November 2019

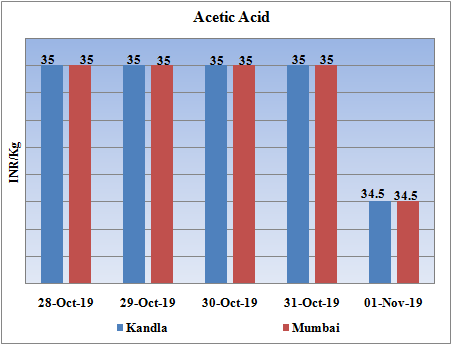

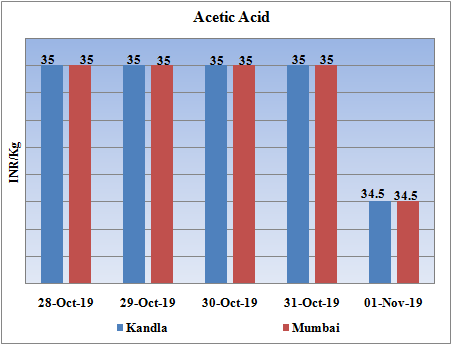

Weekly Price Trend: 28-10-2019 to 1-11-2019

- The above given graph focuses on the Acetic Acid price trend from 28th Oct to 1st Nov 2019. If we take a quick look at the above given weekly prices, it can be observed that prices remained vulnerable for this week.

- By end of the week prices were assessed at the level of Rs.34.5/Kg, slightly reduced for this week.

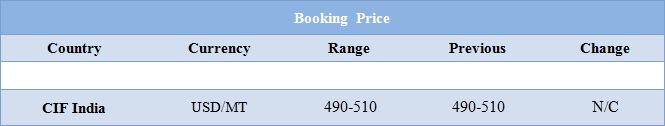

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid were assessed around Rs.34.5/Kg for Kandla and for Mumbai port of India.

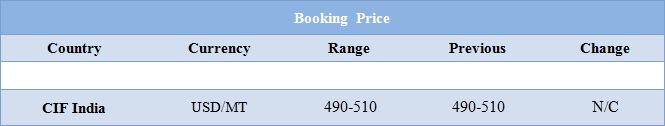

- CIF India prices for Acetic Acid were assessed around USD 490-510/MT, remained unchanged for this week.

- Prices for Methanol reduced slightly for this week. CFR India prices were assessed at the level of USD 211/MT, reduced by USD 4 for this week in compare to last week’s closing values.

- Indian markets are operating on reduced rate as country is festive mood. Market has not resumed its operations in full swing and will operate with full capacity Monday onwards.

- Moreover the political turmoil over the formation of government in Maharashtra state has been concern for the traders as well as business leaders.

- Oil prices steadied on Friday after a rough week, squeezed about 4 per cent lower by a combination of rising global supply and uncertain future demand.

- Worries over global economic growth, along with oil demand, continued to haunt the market as leaders from the United States and China continue to struggle to end a 16-month dispute that has roiled trade between the world's top two economies. "Concerns about the US-China trade dispute have come home to roost," said Stephen Innes, Asia Pacific market strategist at AxiTrader. "Framing this doom and gloom view is the massive US inventory build and the horrendous economic data released over.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $54.18/bbl. Prices have decreased by 0.88/bbl in compared to last closing prices. While Brent on Inter Continental Exchange is decreased by 0.38/bbl in compare to last closing price and was assessed around $60.23/bbl.

1$: Rs. 70.81

Import Custom Ex. Rate USD/ INR: 72.30

Export Custom Ex. Rate USD/ INR: 70.60